Do You Pay Vat On Restaurant . what to know as a small business in south africa. it is mandatory for any business to register for vat if the income earned in any consecutive twelve month. if you are registered for vat, you need to add 15% vat to your selling price. the following vat rates are applicable in the restaurant sector: An intermediate rate of 10 %. For instance, if you sell a product of r100, you need to add r15 to the price. A reduced rate of 5.5 %. the subject of the application,therefore, was whether the restaurants (as employers) would be. As a small business owner in south africa, there are a few things you need to know about vat. First and foremost, vat is mandatory for all businesses that make taxable supplies. A standard rate of 20 %. revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to.

from www.newsbytesapp.com

A reduced rate of 5.5 %. what to know as a small business in south africa. the subject of the application,therefore, was whether the restaurants (as employers) would be. As a small business owner in south africa, there are a few things you need to know about vat. if you are registered for vat, you need to add 15% vat to your selling price. An intermediate rate of 10 %. First and foremost, vat is mandatory for all businesses that make taxable supplies. A standard rate of 20 %. it is mandatory for any business to register for vat if the income earned in any consecutive twelve month. revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to.

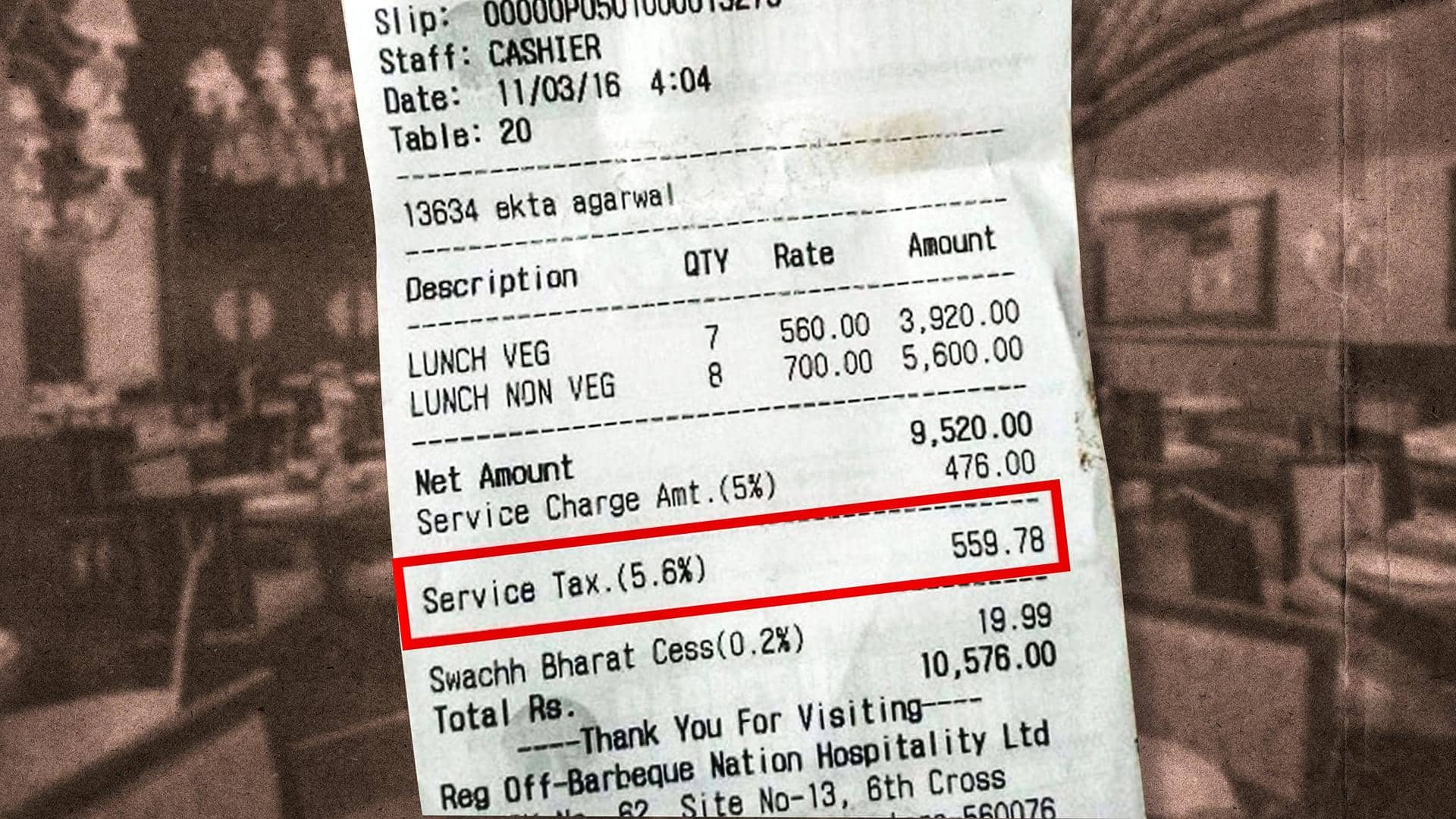

You can deny paying service charge at restaurants. Here's why

Do You Pay Vat On Restaurant An intermediate rate of 10 %. revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to. it is mandatory for any business to register for vat if the income earned in any consecutive twelve month. the following vat rates are applicable in the restaurant sector: As a small business owner in south africa, there are a few things you need to know about vat. A standard rate of 20 %. First and foremost, vat is mandatory for all businesses that make taxable supplies. if you are registered for vat, you need to add 15% vat to your selling price. An intermediate rate of 10 %. For instance, if you sell a product of r100, you need to add r15 to the price. the subject of the application,therefore, was whether the restaurants (as employers) would be. what to know as a small business in south africa. A reduced rate of 5.5 %.

From dxoxldjqq.blob.core.windows.net

Food Service Charge at Bonnie Pauley blog Do You Pay Vat On Restaurant First and foremost, vat is mandatory for all businesses that make taxable supplies. A reduced rate of 5.5 %. An intermediate rate of 10 %. A standard rate of 20 %. revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to. the subject of the application,therefore, was whether the restaurants (as employers). Do You Pay Vat On Restaurant.

From travel.stackexchange.com

uae How to calculate Municipality fee, Service charge, and VAT for Do You Pay Vat On Restaurant revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to. A reduced rate of 5.5 %. First and foremost, vat is mandatory for all businesses that make taxable supplies. the subject of the application,therefore, was whether the restaurants (as employers) would be. A standard rate of 20 %. the following vat. Do You Pay Vat On Restaurant.

From www.livemint.com

Eating out and the various taxes that you have to pay Do You Pay Vat On Restaurant For instance, if you sell a product of r100, you need to add r15 to the price. As a small business owner in south africa, there are a few things you need to know about vat. if you are registered for vat, you need to add 15% vat to your selling price. A standard rate of 20 %. . Do You Pay Vat On Restaurant.

From www.full-suite.com

Computation of VAT Output VAT Input VAT = VAT Payable Do You Pay Vat On Restaurant As a small business owner in south africa, there are a few things you need to know about vat. A standard rate of 20 %. First and foremost, vat is mandatory for all businesses that make taxable supplies. For instance, if you sell a product of r100, you need to add r15 to the price. it is mandatory for. Do You Pay Vat On Restaurant.

From vatregistrationuae.com

How to Implement VAT for Restaurants in UAE? Do You Pay Vat On Restaurant revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to. A reduced rate of 5.5 %. As a small business owner in south africa, there are a few things you need to know about vat. First and foremost, vat is mandatory for all businesses that make taxable supplies. what to know as. Do You Pay Vat On Restaurant.

From www.newsbytesapp.com

You can deny paying service charge at restaurants. Here's why Do You Pay Vat On Restaurant A reduced rate of 5.5 %. First and foremost, vat is mandatory for all businesses that make taxable supplies. As a small business owner in south africa, there are a few things you need to know about vat. what to know as a small business in south africa. the subject of the application,therefore, was whether the restaurants (as. Do You Pay Vat On Restaurant.

From www.youtube.com

Restaurant VAT Billing Software Touch POS Billing Software Restaurant Do You Pay Vat On Restaurant the following vat rates are applicable in the restaurant sector: First and foremost, vat is mandatory for all businesses that make taxable supplies. it is mandatory for any business to register for vat if the income earned in any consecutive twelve month. revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise. Do You Pay Vat On Restaurant.

From restaurant.eatapp.co

VAT Implementation in UAE and Its Impact on the Restaurant Industry Do You Pay Vat On Restaurant An intermediate rate of 10 %. the subject of the application,therefore, was whether the restaurants (as employers) would be. what to know as a small business in south africa. First and foremost, vat is mandatory for all businesses that make taxable supplies. A standard rate of 20 %. For instance, if you sell a product of r100, you. Do You Pay Vat On Restaurant.

From vatcalcuk.com

VAT on Food and Drinks in Restaurants 2024 Do You Pay Vat On Restaurant the following vat rates are applicable in the restaurant sector: First and foremost, vat is mandatory for all businesses that make taxable supplies. the subject of the application,therefore, was whether the restaurants (as employers) would be. it is mandatory for any business to register for vat if the income earned in any consecutive twelve month. revenue. Do You Pay Vat On Restaurant.

From www.goforma.com

The £85k VAT Threshold 19 Things You Need to Know about VAT Do You Pay Vat On Restaurant An intermediate rate of 10 %. A standard rate of 20 %. if you are registered for vat, you need to add 15% vat to your selling price. revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to. the following vat rates are applicable in the restaurant sector: it is. Do You Pay Vat On Restaurant.

From www.nairaland.com

Do Customers Actually Pay The VAT For Fastfoods And Others? Pics Do You Pay Vat On Restaurant it is mandatory for any business to register for vat if the income earned in any consecutive twelve month. First and foremost, vat is mandatory for all businesses that make taxable supplies. what to know as a small business in south africa. revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise. Do You Pay Vat On Restaurant.

From www.mypos.com

All you need to know about VAT on food in restaurants myPOS Do You Pay Vat On Restaurant the subject of the application,therefore, was whether the restaurants (as employers) would be. An intermediate rate of 10 %. if you are registered for vat, you need to add 15% vat to your selling price. the following vat rates are applicable in the restaurant sector: First and foremost, vat is mandatory for all businesses that make taxable. Do You Pay Vat On Restaurant.

From www.tide.co

A Complete Guide to VAT Codes the Full List Tide Business Do You Pay Vat On Restaurant what to know as a small business in south africa. As a small business owner in south africa, there are a few things you need to know about vat. revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to. the subject of the application,therefore, was whether the restaurants (as employers) would. Do You Pay Vat On Restaurant.

From www.deskera.com

Philippines VAT and BIR A Complete Guide for Businesses Do You Pay Vat On Restaurant As a small business owner in south africa, there are a few things you need to know about vat. if you are registered for vat, you need to add 15% vat to your selling price. the following vat rates are applicable in the restaurant sector: A reduced rate of 5.5 %. the subject of the application,therefore, was. Do You Pay Vat On Restaurant.

From www.cdaaudit.com

VAT on Restaurants VAT Services for Restaurants in Dubai, UAE Do You Pay Vat On Restaurant if you are registered for vat, you need to add 15% vat to your selling price. An intermediate rate of 10 %. revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to. As a small business owner in south africa, there are a few things you need to know about vat. A. Do You Pay Vat On Restaurant.

From www.tide.co

What is VAT, how much is it and how much to charge? Tide Business Do You Pay Vat On Restaurant As a small business owner in south africa, there are a few things you need to know about vat. A standard rate of 20 %. An intermediate rate of 10 %. the following vat rates are applicable in the restaurant sector: revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to. . Do You Pay Vat On Restaurant.

From www.invoicera.com

Understanding VAT On Food In The Food Industry Invoicera Do You Pay Vat On Restaurant the following vat rates are applicable in the restaurant sector: revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to. An intermediate rate of 10 %. the subject of the application,therefore, was whether the restaurants (as employers) would be. First and foremost, vat is mandatory for all businesses that make taxable. Do You Pay Vat On Restaurant.

From dxoqpwffc.blob.core.windows.net

Do You Pay Vat On Coffee at Marisol Sterling blog Do You Pay Vat On Restaurant A reduced rate of 5.5 %. An intermediate rate of 10 %. it is mandatory for any business to register for vat if the income earned in any consecutive twelve month. As a small business owner in south africa, there are a few things you need to know about vat. revenue is raised for government by requiring certain. Do You Pay Vat On Restaurant.